TrustCloud Pay

Digital transactions with electronic payment evidence

- Obtaining data from payment gateways

- Digital Identity Platform

- Custody of evidence in TrustCloud Quantum Vault

TrustCloud Pay Process

TrustCloud Pay

Process

TrustCloud Pay seamlessly integrates with any existing digital infrastructure, connecting to payment gateways and identity verification systems, ensuring smooth interoperability.

The platform’s flexibility allows for swift customization to adapt to different security protocols, identity verification requirements, and payment processing standards.

Data acquisition

The solution gathers digital identity evidence and data from payment gateways for each transaction, creating a comprehensive record.

Audit record creation

TrustCloud Pay generates an electronic audit record that logs all events and activities associated with the transaction.

Storage

All transaction data is securely stored in TrustCloud Quantum Vault, protected by robust encryption protocols and security measures.

Access and analysis

Authorized users can access and analyze transaction data, ensuring compliance, security, and transparency.

Benefits

Trust and transparency

TrustCloud Pay fosters trust among stakeholders by offering transparent, verifiable, and traceable transactions. This transparency is crucial for building strong customer relationships and preventing fraud.

Compliance

It simplifies compliance efforts by maintaining a comprehensive record of transactions and digital identity evidence. TrustCloud Pay helps organizations stay current with regulatory changes and requirements.

Dispute resolution

In cases of disputes or chargebacks, the electronic audit record provides irrefutable evidence, facilitating efficient dispute resolution and reducing associated costs.

Real-time analysis

Real-time monitoring of activities enables immediate detection of suspicious or unusual transactions.

Savings

By automating the acquisition and storage of transaction-related data, TrustCloud Pay reduces manual efforts, saving time and operational costs.

Use Cases

Financial services

Enhances fraud detection and aids banking, lending, and investment services in complying with strict regulations.

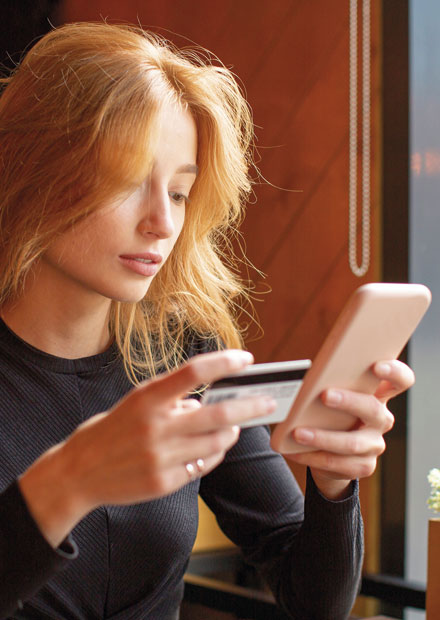

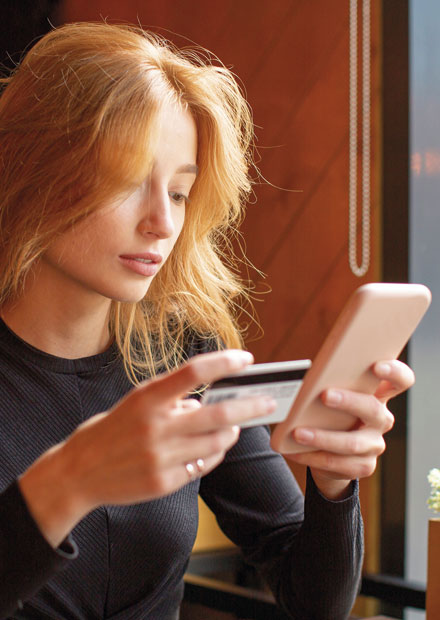

E-commerce

Prevents chargebacks, protecting businesses and users against online fraud and improving customer satisfaction.

Health

Ensures the security and privacy of patient data in electronic health records.

Legal

Maintains secure records for legal proceedings.

Government

Increases transparency in government transactions, reducing the risk of corruption.

Supply chain

Improves traceability and accountability in supply chain management.

FAQS

What are electronic payments?

Electronic payments refer to any form of financial transaction conducted using electronic means rather than cash or any other physical medium. These payment methods are an integral part of the digital economy and have gained popularity due to their convenience, speed, and efficiency.

What types of electronic payments are there?

Some common forms of electronic payment include debit and credit cards, electronic transfers, online payments through platforms like PayPal or Stripe, cryptocurrencies (Bitcoin, Ethereum, etc.), digital wallets, and proximity payments (NFC, Near Field Communication).

What does QTSP mean?

Trust Service Providers (TSPs) are entities that provide secure electronic services, such as creating electronic signatures, time stamps, secure website authentication, among others. They are neutral entities that act as intermediaries in a transaction or agreement to ensure compliance with terms and protect the interests of the involved parties. A Qualified Trust Service Provider (QTSP) is a TSP that meets certain additional criteria and standards defined by the eIDAS regulation.

What is TrustCloud Quantum Vault?

All assets and data generated in transactions with TrustCloud Pay are stored in our module, TrustCloud Quantum Vault. This module secures and protects all types of files in any format (audio, video, images, etc.) in a tamper-proof environment. Additionally, TrustCloud Pay issues a transaction completion certificate with corresponding timestamps, creating a unique record for each client.

As a Qualified Trust Service Provider (QTSP) under the eIDAS regulation, TrustCloud can enable the burden of proof reversal. In case of a dispute regarding the authenticity of a digital asset, the service provides evidence to verify whether the presented content matches what is safeguarded by TrustCloud.