The abandonment rate in the financial industry can be reduced — but only by addressing the underlying causes and redesigning digital experiences with real user needs in mind.

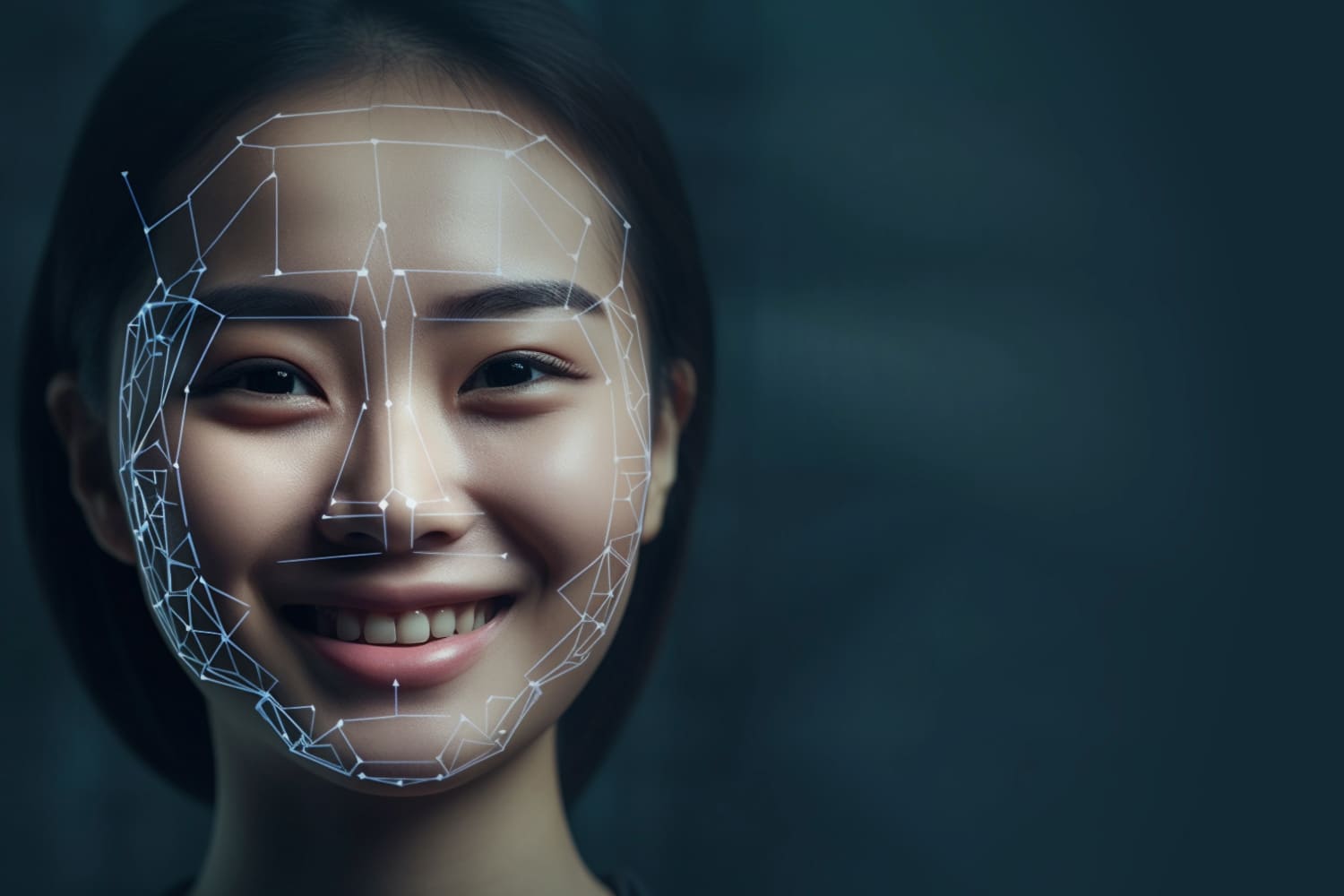

How to detect fraud in video identification processes?

Fraud through video identifications threatens the security of businesses and users in digital environments. TrustCloud Assisted VideoID is a comprehensive solution to combat this issue, offering robust protection against identity theft and deepfakes.

Security gaps in video identification: obstacles to digital trust

V

ideo identification has become a fundamental tool for verifying identity in the digital realm. It enables companies and organizations to confirm the identity of their users remotely and securely, through an automated video call or with the help of a video agent. This resource has redefined the relationship between consumers and companies and has streamlined normally cumbersome and insecure procedures with banks, insurers, or gaming platforms.

However, there is still a long way to go. This process is not without risks, and cybercriminals work tirelessly to invent new techniques and bypass all security protocols. Fraud in video identification is a reality that can have serious consequences, both for companies and users.

Figures on a massive phenomenon

A 2024 report by Onfido highlights that 85% of video identification fraud globally is carried out by presenting a fake video on a screen.

Another study, conducted by Juniper Research in 2023, estimated the cost of fraud on a global scale to be close to $17 billion. In Spain, for example, according to a report by Rubricae, 53% of companies claim to have experienced more attempts and cases of fraud in video identifications in the last year.

This upward trend is reflected in damages to reputation that erode the trust of users and customers. A single case of identity theft that makes headlines in the media or social networks can generate negative publicity and affect the brand image.

In some cases, fraud in video identification can have legal consequences for companies, so its effects should not be underestimated. For example, if a company allows a fraudulent user to open a bank account, it could be held responsible for the criminal activities they engage in.

What are the most common fraud methods in video identification?

- Identity theft: The most common method of fraud in video identification is identity theft. In this case, the fraudster uses another person’s identity to create an account or make a transaction.

- Use of fake documents: Fraudsters can also use fake identity documents to deceive video identification systems.

- Deepfakes: Deepfakes are manipulated or entirely fabricated videos that mimic real faces or voices and can be used to create a false identity. This technology is becoming increasingly sophisticated and poses a growing challenge to video identification.

Comprehensive prevention programs: key to mitigating damage and strengthening video identification

Companies must develop holistic programs to prevent fraud in video identification, incorporating measures such as:

- Utilizing robust identity verification technology: There are various technologies available to help detect fraud, such as facial analysis, document verification, and video manipulation detection.

- Implementing solid identity verification processes: It’s crucial to have well-defined identity verification processes that include multiple verification steps and ideally cause minimal friction for the user.

- Training employees: Employees involved in video identifications should be extensively trained in digital identity and fraud prevention.

In addition to the mentioned measures, it’s essential for companies to stay informed about the latest trends in video identification fraud (such as deepfakes, as mentioned earlier). This allows them to adapt their verification processes and stay ahead of new strategies.

Sectors most affected by fraud in video identification

Some sectors are particularly vulnerable as they handle large amounts of sensitive data. Despite being subject to strict regulations, they are magnets for fraudsters due to the high value of the information they manage.

- Financial services: Banks, insurance companies, and stockbrokers are highly attractive targets for fraudsters as they concentrate money and personal data.

- E-commerce: Fraud in e-commerce is also a significant issue. Fraudsters can create fake accounts, make fraudulent purchases, and steal consumers’ personal information.

- Postal services: In recent years, scams related to postal services have intensified, parallel to the diversification of their products and methods for verifying users’ identities, including video identification to obtain digital certificates or receive orders.

- Healthcare sector: In this case, fraudsters focus on accessing medical records, prescribed medications, and other services, facilitated by the adoption of technologies to improve patient care.

- Gaming sector: The gaming sector is frequently used by criminals for money laundering, making it an industry that particularly needs to strengthen its identification processes.

- Public administration: In this case, committing fraud through video identification could be used to apply for social benefits or obtain fake identity documents.

TrustCloud Assisted VideoID: the ultimate ally in mitigating fraud in video identifications

In the battle against fraud in video identifications, TrustCloud VideoID stands out as the most competent choice in the market, combining cutting-edge technology with the support of a team of video agents skilled in fraud prevention and identity management. The effectiveness of TrustCloud VideoID can be summarized through several key points.

Different configurable layers of security, such as proof of life checks, are combined to facilitate the most robust identification procedures. The goal is to ensure that the person on the other side of the screen is who they claim to be. Background execution of Artificial Intelligence algorithms helps verify the absence of deepfake usage.

Furthermore, all video calls are recorded for later review, ensuring complete traceability and aiding in the identification of suspicious patterns. Regular audits of video identification sessions are also conducted to ensure compliance with security standards and to detect any irregularities.

VideoID enhances user experience, reduces abandonment rates, and includes features such as audio assistance or real-time text chat to ensure full accessibility for individuals with digital difficulties, deafness, or those unaccustomed to these channels.

TrustCloud Assisted VideoID is committed to Regulatory Compliance in any territory, adhering to the strictest standards of data security and privacy, thus providing peace of mind to both users and their clients.

An impenetrable barrier against deepfakes

In 2023, the world of financial security faced an unprecedented challenge with a 31-fold increase in deepfake attempts compared to the previous year, representing a growth of 3000%. Most people are unable to distinguish a deepfake from a real image. This is evidenced by the rise in crimes such as “CEO fraud,” costing millions of dollars to companies worldwide.

In a landscape where deepfake technology becomes increasingly aggressive and sophisticated, the ability to detect and prevent their fraudulent use in identity verification processes is crucial. TrustCloud VideoID incorporates the most advanced deepfake detection techniques to ensure maximum security for its users.

As experts in secure digital transactions, we apply cutting-edge technology based on state-of-the-art Artificial Intelligence models trained to the highest standards, capable of recognizing the distinctive patterns of deepfakes.

This technology is applied from our platform in real-time identification processes and also in retrospective data analysis. It covers both images and videos and is backed by a team of experts in artificial intelligence and cybersecurity who constantly work to stay up-to-date with the latest trends and techniques in deepfake generation. Advanced algorithms are used during the process to analyze the probability of impersonation or attempted identity theft using real images of individuals. They also assess the integrity of video content to identify any facial manipulations and determine whether a face in an image is real or generated using GANs.

TrustCloud combines a set of sophisticated techniques to identify deepfakes with high precision. In summary:

- Advanced Facial Analysis: An analysis of the user’s face is conducted during the process, searching for anomalies and inconsistencies that could indicate video manipulation. Once the images of the documents are captured and the video identification is completed, the deepfake detection functionality runs smoothly, capable of analyzing whether there is manipulation of video, photos, or GANs (Generative Adversarial Networks): the creation of synthetic identities or human faces through AI using parts taken from the network.

- Detection of Artificial Intelligence Patterns: Specialized artificial intelligence algorithms are employed to detect characteristic patterns of deepfakes (or GANs), such as artificial micro facial movements or inconsistencies in skin texture.

- Comparison with Identity Documents: The user’s image is compared with the photo on their identity document, verifying the correspondence of facial features and preventing impersonation through high-quality deepfakes.

TrustCloud’s automatic detection of deepfakes protects individuals’ identities, always with prior informed consent regarding the use of their biometric information, and fortifies video identification, KYC (Know Your Customer), and KYB (Know Your Business) processes. It focuses on attacking all fronts of a deepfake procedure and seamlessly integrates within complex transactions.

In conclusion, TrustCloud Assisted VideoID not only provides robust protection against fraud, with a special focus on deepfakes but also has a positive impact on users’ perception of identification technologies. By offering a personalized and secure experience, it strengthens user trust and reduces resistance toward these systems. Furthermore, by complying with the strictest standards of security and privacy, it maximizes resources and enhances the image of companies, especially those subject to rigorous regulations.

Contact our specialists and avoid fraud and financial losses